Fraud is a serious problem that affects individuals, businesses, & the economy & the best way to overcome it is fraud awareness. To know more about it. click here!

Introduction

Fraud is a serious problem that affects individuals, businesses, and the economy as a whole. It can take many forms, from identity theft and credit card fraud to investment scams and tax evasion. The best way to combat fraud is to raise fraud awareness. Being aware of it helps protect personal information and property. This page provides information on fraud, how it happens, and what we can do to prevent it.

Overview of fraud awareness

Fraud awareness is essential for individuals and businesses alike. There are many different types of fraud, and it can be challenging to keep track of all the different ways people can commit fraud.

Fraud is “dishonest or illegal activity with the intention of gain or causing loss”. This can include activities such as

- Forgery: creating or altering documents to deceive others

- Identity theft: using another person’s identity to commit fraud

- Money laundering: hiding the origins of illegally obtained money

- Bribery and corruption: offering or accepting bribes in exchange for favors or influence

The most common types of fraud

Fraud comes in many forms, but some are more common than others. There are several types of fraud, but the following are the most common:

- Identity theft

Identity theft occurs when someone uses one’s personal information to commit fraud or other crimes against them. This can include stealing their credit card numbers, social security numbers, date of birth, and other information to open new accounts in their name or make purchases without their knowledge.

- Phishing

Phishing scams are emails that appear legitimate but are attempts by criminals to trick one into revealing personal information such as user names and passwords, credit card numbers, and social security numbers.

- Bank fraud

A bank fraud occurs when someone obtains access to a person’s bank account information without their permission in order to withdraw money or conduct unauthorised transactions. Bank fraud is a type of fraud committed to a financial institution. It can take many forms, including check fraud, credit card fraud, and identity theft.

- Credit card fraud

Credit card fraud is the act of using a stolen or fake credit card to make purchases. Credit card fraud can occur online or in person, and can include using a stolen credit card to make online purchases, or using a fake card to purchase goods at a store.

- Insurance fraud

Fraudulent insurance claims cost billions of dollars every year. It’s a problem that can affect anyone. In this article, we’ll be looking at insurance fraud, why it happens, and how one can avoid being a victim of an insurance fraud scam.

- Investment fraud

Investment fraud is a type of financial fraud that involves the misuse of money by investors. They typically make investments through a broker or financial advisor, who may be legally required to act in the investor’s best interest, but who may instead take advantage of an investor’s trust to make a quick profit for themselves.

- Tax fraud

This refers to any type of fraudulent activity related to taxes, such as claiming false deductions or filing false returns. Tax fraud occurs when someone intentionally falsifies or omits information on their tax return or works with someone else to give false information on their tax return. The IRS considers this fraud a crime and can impose fines and penalties for those who commit it.

- Phone fraud

These scams involve using a telephone to contact potential victims, often to collect personal information or money. Phone frauds typically involve using a telephone number that appears to be local but is being routed through another location, often overseas. In some cases, telemarketers will sell consumers goods or services they don’t need and have not ordered; in others, they may inform the consumer that they have won something (like an all-expenses-paid vacation) and then charge them for it.

- Internet auction fraud

Internet auction frauds occur when criminals use false identities and fake financial information to buy low-priced items and then sell them for profit on websites like eBay or Craigslist.

KYC Compliance

Know Your Customer (KYC) is a regulatory and legal framework adopted globally by financial institutions and other regulated entities to prevent identity theft, financial fraud, money laundering, and terrorist financing. KYC compliance ensures that businesses verify the identity of their clients, understand their financial dealings, and assess the risks associated with maintaining a business relationship with them. Here’s a deeper dive into KYC compliance:

- Purpose of KYC: The primary objective of KYC is to enable businesses to understand their customers better and manage their risks prudently. By verifying the identity of their clients, institutions can ensure they are not inadvertently involved in corrupt practices or illegal activities.

- Key Components:

- Customer Identification Program (CIP): This involves collecting and verifying the customer’s essential information, such as name, date of birth, address, and identification numbers.

- Customer Due Diligence (CDD): This process involves assessing the risk level of customers based on their financial activities and understanding the purpose of their accounts.

- Enhanced Due Diligence (EDD): For high-risk customers, more in-depth scrutiny is required, which may involve understanding the sources of their funds, and the nature of their business activities, and monitoring their transactions more closely.

- Documentation: KYC compliance often requires customers to provide various documents, including government-issued identification cards, proof of address, and sometimes financial statements or details about the nature of their business.

- Ongoing Monitoring: KYC is not a one-time process. Financial institutions must continuously monitor customer transactions to identify any suspicious activities and report them to the relevant authorities.

- Benefits:

- Risk Management: By understanding their customers, institutions can manage risks better and protect themselves from potential financial losses or legal implications.

- Legal Compliance: Adhering to KYC norms ensures that institutions are not in violation of anti-money laundering (AML) laws and other regulations.

- Enhanced Trust: For customers, knowing that their financial institution follows KYC norms can boost confidence and trust in the institution’s practices.

Customer Identification Program (CIP)

The Customer Identification Program (CIP) is a critical component of the Know Your Customer (KYC) regulations, particularly in the United States. It is a set of procedures that financial institutions must follow to verify the identity of their customers. The main goal of CIP is to prevent identity theft, financial fraud, money laundering, and terrorist financing. Here’s a closer look at the key aspects of the Customer Identification Program:

- Legal Requirement: The USA PATRIOT Act of 2001 requires financial institutions to implement a CIP as part of their anti-money laundering (AML) program. This act was introduced to strengthen the measures against terrorist financing and money laundering.

- Verification of Identity: When a customer opens an account, the financial institution must verify the customer’s identity. This typically involves collecting name, date of birth, address, and an identification number (such as a Social Security number in the U.S.).

- Documentary Verification: The CIP requires institutions to examine one or more documents to verify the customer’s identity. These documents can include a driver’s license, passport, or other government-issued identification.

- Non-Documentary Verification: In addition to or in place of documentary verification, institutions may use non-documentary methods. This could involve checking the customer’s credit report, verifying their employment, or using third-party services to confirm their identity.

- Recordkeeping: Financial institutions must keep records of the information used to verify a person’s identity. This includes copies of identification documents and a description of any non-documentary methods used.

- Customer Notice: Institutions must provide notice to customers that they are requesting information to verify their identity. This notice is typically provided at the time of account opening.

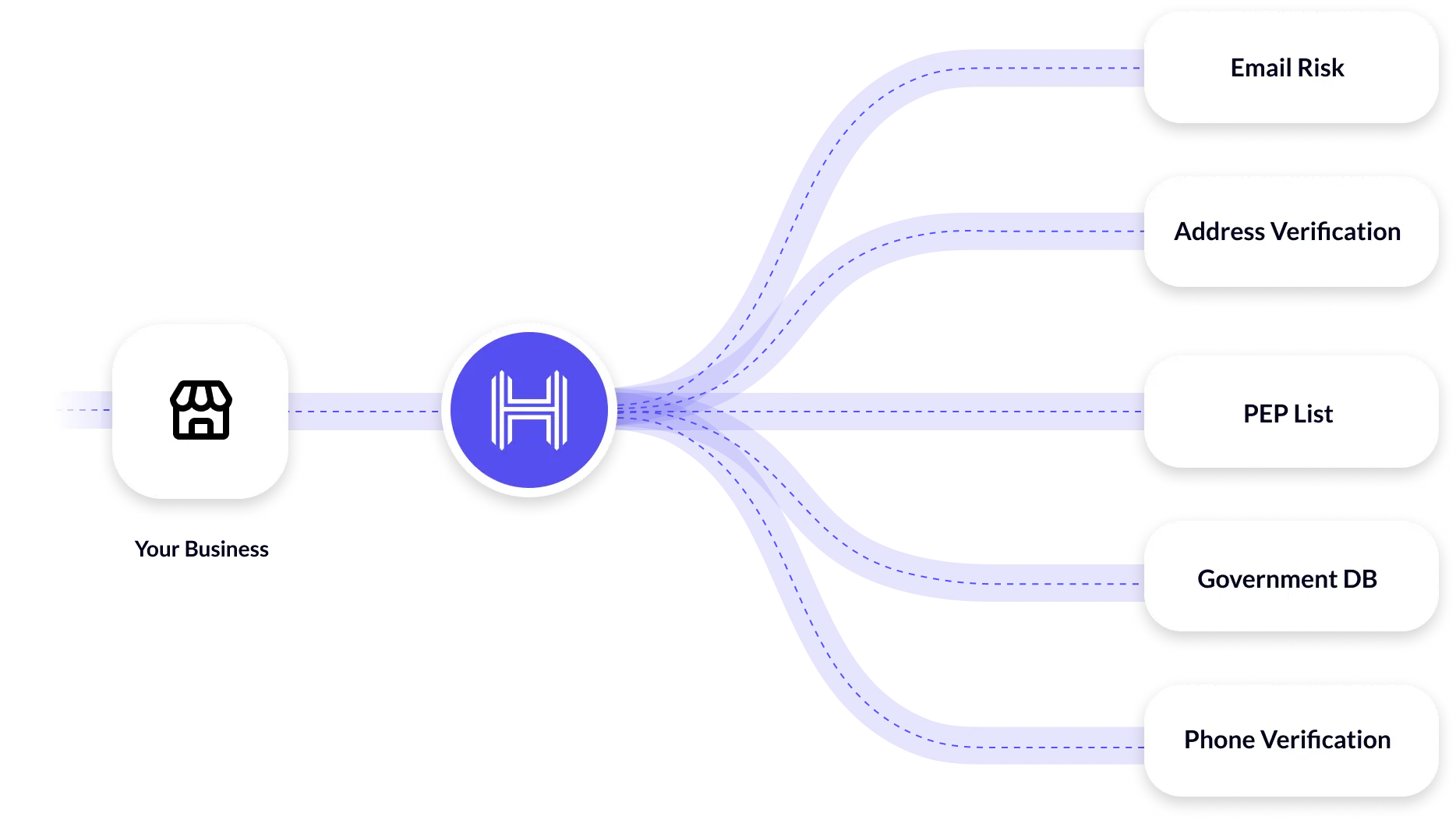

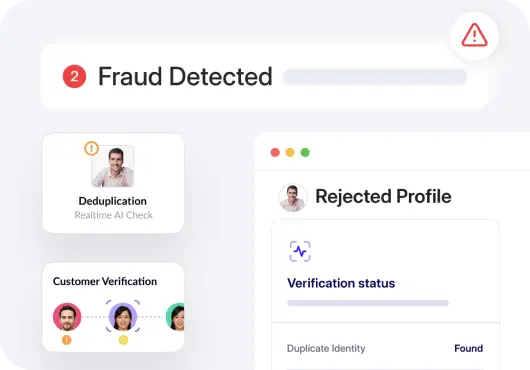

How Fraud Prevention Works?

Fraud prevention involves a series of steps and strategies to detect, prevent, and respond to fraudulent activities. Here’s how it typically works:

- Identification: The first step is identifying potential fraud indicators. This can be done through automated systems that monitor transactions and user behavior for signs of fraud.

- Verification: When potential fraud is detected, further verification is often required. This may involve additional authentication steps, customer contact, or analysis by fraud prevention specialists.

- Analysis: Analyzing the nature and pattern of the fraudulent activity is crucial. This helps in understanding the methods used by fraudsters and in developing strategies to counter them.

- Prevention Measures: Implementing measures to prevent fraud includes setting up strong authentication processes, encryption, secure communication channels, and educating customers about safe practices.

- Monitoring: Continuous monitoring is essential for early detection of fraudulent activities. This includes monitoring transactions, user behavior, and system vulnerabilities.

- Response and Recovery: In case of a fraud incident, having a response plan is crucial. This includes steps to mitigate damage, recover lost funds or data, and inform affected parties.

- Learning and Adapting: After a fraud incident, analyzing what happened and learning from it is important. This information is used to improve fraud prevention measures and to adapt to new tactics used by fraudsters.

How to Choose Fraud Detection & Prevention Features

Selecting the right fraud detection and prevention features is crucial for protecting your business and customers. Here are key factors to consider when choosing these features:

- Comprehensiveness: Ensure the solution covers a wide range of fraud types, including identity theft, payment fraud, account takeover, and more. It should be capable of detecting both known and emerging fraud patterns.

- Real-time Detection: Opt for features that offer real-time fraud detection. The ability to identify and respond to fraudulent activities as they occur is essential for minimizing damage.

- Machine Learning and AI: Advanced fraud detection systems use machine learning and artificial intelligence to analyze patterns and predict fraudulent behavior. These technologies can adapt and improve over time, offering more effective protection.

- Integration and Scalability: The solution should integrate seamlessly with your existing systems and be scalable to accommodate your business’s growth. It should work well with your data infrastructure and not require extensive modifications.

- User Experience: Fraud detection measures should not overly complicate or hinder the user experience. Solutions that provide security without significantly slowing down transactions or creating unnecessary hurdles are preferable.

- Regulatory Compliance: Ensure the features comply with relevant regulations and industry standards. This is particularly important for businesses in highly regulated sectors like finance and healthcare.

- Customization and Flexibility: The ability to customize rules and settings to fit your specific business needs is important. Different businesses have different risk profiles and operational requirements.

- Support and Expertise: Consider the level of support and expertise offered by the provider. Access to knowledgeable support teams and ongoing updates to the system are valuable.

- Cost-Effectiveness: Evaluate the cost relative to the features and protection offered. The most expensive solution is not always the best, but neither is the cheapest if it fails to provide adequate protection.

It is important to stay informed and up-to-date on the latest scams and schemes to protect an individual from falling victim to them. If a person thinks they may have been a victim of fraud, or if they have any questions about fraud awareness, they may contact the Federal Trade Commission (FTC). The FTC has several resources available to help customers report and recover from identity theft and other types of fraud.

FAQs

What is fraud awareness?

Fraud is a type of crime that involves deception to gain something of value. Fraud awareness is understanding and recognizing deceptive practices aimed at obtaining something of value through dishonest means. It involves educating individuals and organizations about various types of fraud to help them detect and prevent such activities.

What are the red flags of potential fraud?

Red flags of potential fraud include suspicious transactions, unexplained financial transactions, unusual account activity, requests for sensitive information, and discrepancies in documentation. Recognizing these warning signs is essential for early detection and prevention of fraudulent transactions and activities.

Which is the best strategy for preventing fraud? What are the key pillars of fraud prevention?

To prevent being a victim of fraud, be wary of any unexpected or unsolicited requests for personal information or money, regardless of how authentic they may appear. Also, do not click on links in email messages from unknown senders; instead, type in the website’s address to ensure that a legitimate site is being visited.

How do I report fraud?

If a user thinks that they have been a victim of fraud, they must report it to their local law enforcement agency and the Federal Trade Commission (FTC).

What are the consequences of committing fraud?

The consequences of fraud can be severe, including jail time and/or heavy fines.