Financial fraud is when an individual or entity intentionally commits misleading or illegal methods to obtain money or assets unlawfully or otherwise harms the victim financially. This can be done through various methods, such as identity theft and investment fraud, where victims are misled or influenced into financial losses.

According to the newly released Federal Trade Commission data, consumers reported losing over $10 billion to fraud in 2023. This marks the first time fraud losses have reached that benchmark, representing a 14% increase over reported losses in 2022.

Financial Fraud is a massive threat to businesses, causing monetary losses and reputational harm. Understanding financial crime, its consequences, and how it happens is essential for prevention.

In this article, we’ll help you understand the importance of safeguarding businesses against various types of financial fraud, its potential impact, associated risks, how such frauds occur, and effective strategies for prevention.

The Impact of Financial Fraud

Financial fraud poses significant risks to individuals, impacting their financial security and well-being. It is crucial to report any instances of financial or insurance fraud to the appropriate authorities immediately. If you notice any suspicious charges, make sure to dispute or cancel them right away.

Additionally, gather all documents related to the fraud, like bank statements, credit reports, and tax forms from previous years. It is imperative to keep track of everything as you report it to law enforcement agencies to help with the investigation.

Financial crime and fraud bring risks like losing money, damaging reputation, and reducing trust among stakeholders of financial institutions. These risks can seriously affect organizations, harming their financial stability and ability to survive in the private sector in the long run.

Financial fraud has severe legal, criminal, and regulatory consequences, including fines, penalties, and legal and criminal actions against those responsible for committing fraud. Failure to comply with laws and regulations can lead to significant consequences, such as damage to business reputation and loss of licenses to operate.

Organizations must understand the impact of financial fraud, its risks, and legal consequences. This knowledge will assist them in implementing effective measures to prevent financial crimes and insurance fraud and ensure that they are compliant with regulatory requirements.

Read more: What is financial crime compliance?

How does financial fraud happen?

Financial fraud involves various methods used to obtain money or assets illegally. Identity theft is a common method where fraudsters steal personal information like Social Security number or credit card number to access financial accounts or make unauthorized transactions.

Another method is phishing, a scheme where scammers pose as legitimate organizations to send money or trick individuals into revealing sensitive information or clicking on harmful links, leading to identity theft or financial or bank account breaches.

Investment scams offer high returns with low risk but are specifically designed that way to trick investors. Ponzi scheme is a classic example. A Ponzi scheme uses funds from new investors to pay returns to earlier ones until the scheme collapses due to insufficient new investments.

Credit card fraud involves the use of stolen credit card information to make unauthorized purchases, both online and offline. False billing involves sending fake invoices for goods or services never provided, aiming to extract payment unnoticed.

Insider fraud occurs when individuals with access to sensitive information misuse their positions to steal money or manipulate financial records. Hackers carry out account takeover schemes by gaining unauthorized access to financial accounts through stolen information or system vulnerabilities.

Mortgage fraud happens when someone lies on their mortgage application to get a loan under false information.

These methods and scams demonstrate the various strategies used by fraudsters to exploit individuals and businesses through financial scams and wire fraud. To combat financial scams and fraud effectively, caution and robust security measures are critical.

Types of financial fraud

Financial fraud can take various forms. Here are some of the common types of financial fraud:

- Identity theft: Fraudsters steal personal information such as social security numbers or credit card details to access financial accounts or make transactions in someone else’s name.

- Advance fee fraud: Scammers trick victims into paying fees upfront for promised services or rewards that never occur. It can be done through phone calls, emails, or text messages.

- Tax refund fraud: Fraudsters file false tax returns to claim refunds using stolen identities or falsified information.

- Credit card fraud: Unauthorized use of someone else’s credit card information to make purchases or withdraw funds online or offline.

- Financial takeovers: Fraudsters gain unauthorized access to financial accounts, often through hacking or phishing, to steal funds or control transactions.

- Laundering of funds: Criminals disguise the origins of illegally obtained money to make it appear legitimate through a series of complex financial transactions.

Strategies for preventing financial fraud

Implementing effective measures to prevent financial fraud is necessary for safeguarding digital assets and maintaining trust. Here are some key strategies:

Use a reliable fraud detection solution

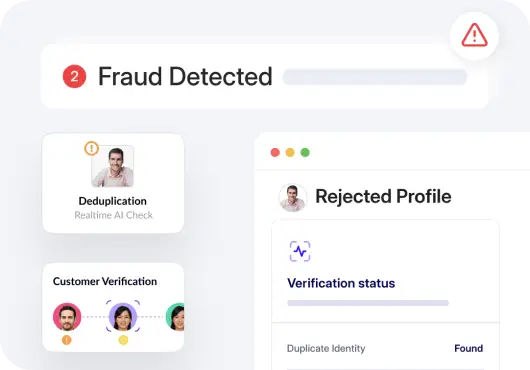

Use advanced fraud detection solutions like Hyperverge’s Fraud Detection solution to identify suspicious activities and prevent fraudulent transactions. These tools use machine learning algorithms and data analysis techniques to detect patterns signifying fraudulent or criminal behavior, enhancing fraud prevention capabilities.

We offer advanced features such as comprehensive fraud detection with signature/thumbprint analysis, photo-on-photo verification, ongoing tampering monitoring, and screen capture/Photo Verification. Our robust authentication for various ID documents enhances the security freeze and overall reliability of the verification process.

Perform biometric verification

Implement biometric authentication methods, such as fingerprint or facial recognition, to verify the identity of users during transactions with personal financial information or bank account numbers to access.

Biometric verification adds an extra layer of security by ensuring that only authorized individuals can see account numbers, access sensitive personal financial information, or conduct transactions.

Our fraud detection module uses advanced algorithms to accurately detect and verify signatures and fingerprints associated with PAN cards, ensuring authenticity.

Credit report and bank statement analysis

Regularly review credit reports and conduct bank statement analysis to report financial fraud and identify any warning signs of unauthorized or suspicious transactions. Analyzing these documents allows for early detection of fraudulent activity, enabling quick action to reduce potential losses and prevent further fraud.

Our fraud detection system is devised to detect and prevent digital tampering, safeguarding against any attempts to alter information within electronic identity documents.

Reporting the suspicious activity

Report suspicious or unusual activity to the appropriate authorities or financial institutions immediately. Timely reporting of potential fraud enables swift investigation and intervention, helping to prevent further financial losses and protect against future fraud attempts.

Reporting financial fraud to the appropriate authorities is of utmost importance. If you notice any suspicious charges, make sure to dispute them or cancel them right away. Also, gather all documents related to the fraud, like bank statements, credit reports, and tax forms from previous years.

Prevent financial fraud with our identity verification solutions

Identity verification solutions play a crucial role in combating financial fraud by ensuring that individuals accessing financial services or conducting transactions are who they claim to be.

By verifying the identity of users through methods such as document verification, biometric authentication, and live photo verification, these solutions help prevent unauthorized access to bank accounts new to credit card numbers, cards, and transactions.

Implementing robust identity verification measures adds an additional layer of security, making it challenging for identity thieves and fraudsters to control stolen information or impersonate bank account numbers of legitimate users. This helps mitigate the risk of identity theft, account takeover, and other fraudulent activities, eventually safeguarding assets and maintaining trust with customers.

For reliable identity verification solutions that enhance your fraud prevention efforts, check out Hyperverge’s identity verification solution.

Sign up today to protect your business and customers from financial fraud.