What is UBO?

As per Anti Money Laundering Act, a person who owns 25% of the company’s shares or controls more than 25% of voting rights or who has significant control or can significantly influence the decision-making powers of any company is described as an Ultimate Beneficial Owner or UBO and enjoys Ultimate Beneficial Ownership.

European Union’s Fourth Anti-money laundering directive (AMLD) also says that any person or entity gains the status of Ultimate Beneficial Owner if it acquires more than 25% of shares, interest, or more than 25% beneficiary in any entity’s capital gains.

The Ultimate Beneficial Owner refers to the actual beneficiary owner regardless of the levels of transaction parties involved. UBO is the person or any legal entity that enjoys the real fruits of any transaction. Every company or individual wants to have transactions with a real entity or person which is the real cause behind the term KYC – Know your customer. KYC is mandated everywhere to provide clarity about one’s customers while the chances of fraud in the digital world of transactions have enhanced.

Whether it is a company, a partnership firm, LLP or any individual, they all want to have transactions with real ultimate beneficiary owners cutting down any connections with any kind of fraudsters. Hence, UBO regulations have been put in place by regulators across the globe to prevent any kind of fraud from these racketeers.

Why is UBO necessary?

International Monetary Fund(IMF) says that money laundering and terrorism funding amounts to more than 1,000 Billion Euros, somewhere between 2.5% to 5% of the world’s GDP.

Ultimate Beneficial Ownership is mandated for knowing the real entity behind any transaction and whether they are by the legitimate owner or not. To prevent any kind of financial fraud, all financial institutions or parties involved want to know the real owner or the beneficiary.

Major entities requiring UBO checks are financial institutions, BFSI, crypto agents, market regulators or any other organization involved in currency-based transactions. These include:

- Banks

- Stock market dealers/brokers

- Financial Market Agents

- Foreign currency exchange agents

- Commodity brokers

- Hedge fund agents

- Future & Options Merchants

- Blockchain agents

- Digital lenders

- Casinos

Who is affected by UBO?

UBO helps prevent high amounts of fines and penalties imposed on any organization due to complex laws and regulations. The anti-money laundering Act is in place to avoid any such illegitimate use of money for any Terror Financing, money laundering, or similar activities. UBO information has to be mandatorily updated in any such case to the parties affected by such transactions, be it any entity, authority, or person.

How does UBO help?

Many fraudsters and terror agents hide behind fake corporates and organizations’ doors, which must be monitored regularly. UBO identification helps in identifying such fraudulent entities and organizations. UBO identification prevents any such malicious intents of these fraudsters. So many mala fide practices have been revealed in the past via tax havens and offshore island frauds. Most of them were successful in criminal activities while framing ‘Ghost Firms’ using fake account details, emails, and identities.

UBO helps establish the credibility of any organization, and when they fail to provide valid financial statements, they become a suspect and a cause for investigation.

UBO helps businesses in:

- Regulatory requirements

- Enhancing customer experience

- Reducing operational costs

- Improving productivity

- Gaining competitive advantage

How to check if UBO is present for an institution/firm?

To ensure whether a UBO is present or not in any particular institution or firm, one must acquire the firm’s credentials relating to its identity.

- This includes enquiring about their firm registration status, name, address of their registered office and details of their government registration under the Companies Act, GST, Unique Identification Number, and details about their top management, including their identity proof, their Aadhaar, PAN or residential proof.

- Check the details of each individual’s ownership, whether he/she/it is a natural entity or a legal entity, and what percentage of shares/interest they hold.

- Checking who holds the maximum interest of percentage in shareholding to fall under the definition of UBO.

- Performing an Anti-Money Laundry/ KYC check of the so-called/deemed UBOs.

What are the various risk categories UBOs fall under?

UBOs carry different measures of risk associated with them. Some are associated with very high risks, while others have only low or moderate risks.

Low-risk UBOs can be asked to submit their self-attested identity details and residential proof. They may simply sign a document stating all their details. As done by most banks, simple checks like identifying faces manually or matching the signatures and IDs can be performed when the associated risk is low.

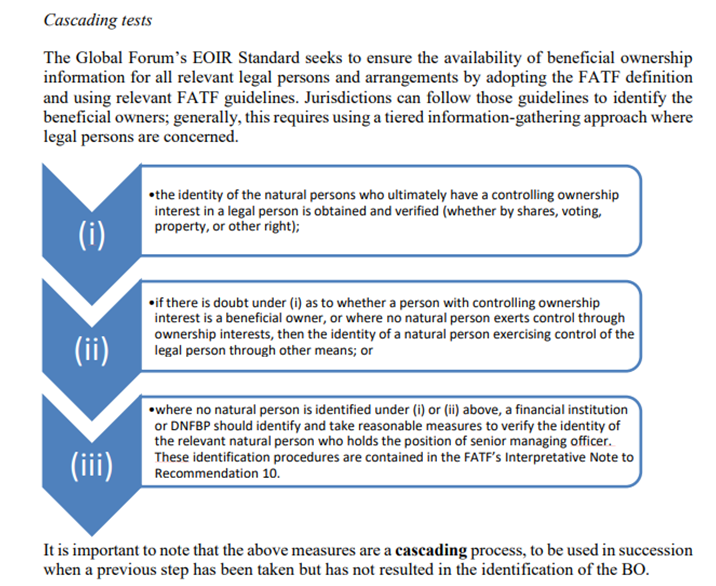

For any such mid to high-risk profiles, where the links may be suspected of AML or terrorist funding detailed investigation must be carried out with enhanced due diligence. The regulatory body Financial Action Task Force (FAFT) has recommended a few measures to keep a check on all such business transactions. These are:

- Calling some additional identification checks and cross-checking them from known sources. Any political exposure, adverse media report, or subject to any legal enforcement calls for some extra precautions and investigation.

- Analyzing the other party’s income source, estimated wealth, and whether they do not come from any criminal or unethical means. Keeping a vigilant eye on any discrepancy will keep one’s business safe from any legal repercussions.

- In case of any doubt, businesses can ask for further information from their prospects about the nature of the business relationship and the intent they wish to have.

- The clause of the annual update of the change in ownership, if any, has been made mandatory in the annual audit report. The Companies Act has mandated this. Business partners can also ask for such updates and seek clarification in case of any suspicion arises.

Conclusion:

Knowing Ultimate Beneficial Ownership is mandatory for the safety of businesses. Several safety partners help businesses track/verify the status of their prospects. Hyperverge is the leading partner who can assist you with all your verification needs.

FAQs

What is the meaning of the Ultimate Beneficial Owner?

An UBO is a person that is the ultimate beneficiary when an institute initiates any transaction.

Who is the ultimate beneficial owner of a company?

Any person who benefits from or is impacted positively by the company’s transactions or holds any significant control over its board or decision-making powers, though not being an owner.

What is a UBO document?

A legal document that gives current, accurate, and reliable information about a company’s true beneficial owners, signed by a verified authorized person.