Did you know that outlaws in the Wild West era were known to murder people to acquire their identity and lead a new life? Fraud is not something new, and it is increasing, rising steadily up the agenda for several organizations as something to minimize effectively and quickly. It is a growing societal and economic issue, not only leading to financial but reputational damage as well. Because of this, organizations are under the scrutiny of the respective governments to manage and mitigate the risk of fraud. Digital transformation has meant that fraud has also evolved along with it. The Asia Pacific leads the world in digital transformation and Singapore in particular has the highest digital transformation index. According to Deloitte, hasty promotion of digitization can pose a serious challenge to existing fraud controls in Southeast Asia. However, by deploying high-end machine learning based on AI, fraud can be identified and reduced. Organizations can also stop fraudsters entering from a particular channel or accessing a particular account.

The specific case of Southeast Asia

Let’s look at Southeast Asia and the most common frauds that happen there.

- In ride hailing and delivery services:

- Phantom bookings and fake transactions have been made to acquire driver incentives, affecting the service organizations detrimentally.

- Identity fraud is on the rise where impersonation affects the safety of the one who avails the service and causes reputational damage to the delivery partner.

Twitter posts with the hashtag #UberAccountHacked: “I had a great ride in China this morning. Except, weird, I wasn’t in China this morning.”

Another: “I am in Bangkok now. But my account showed that I am riding in France.”

- In digital wallets and related services:

- The phishing of OTPs helps fraudsters access other user accounts and perform financial transactions that can cause heavy financial damage to an individual.

- The use of fake merchant accounts allows fraudsters to farm incentives.

- In insurance and loan related services:

- Impersonating the victim and submitting false claims allows fraudsters to get insurance money that is not due to them.

- The use of fake details and authorization allows fraudsters to avail a loan in another’s name when they have been banned or are ineligible.

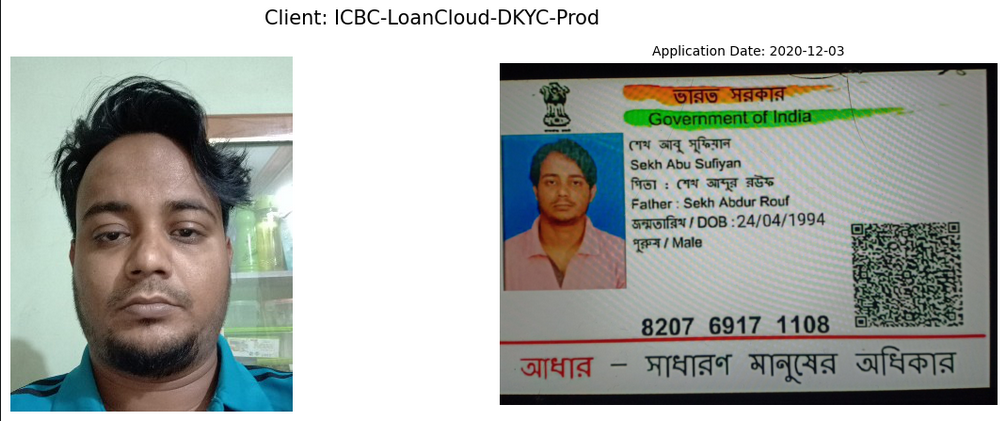

1:1 Face match detection

1:N Facematch detection

@AdvPrashantMali writes: “Sunny Leone claims identity theft #cybercrime, her PAN details allegedly used for a #fintech loan fraud of Rs 2000. A loan was taken against her identity.”

The damage and the solution

These are three areas we picked, but with every arm of the industry going digital, the possibilities are endless. And the economic damage wrought on by them knows no parallel. Businesses in the retail, e-commerce and financial sectors of the Southeast Asian region recorded on average an amount of US$160,000 in losses due to fraudulent transactions every month. There are at least 400 successful fraudulent transactions against them a month. Each fraudulent transaction further cost these businesses 3.5x the lost transaction value. These numbers are alarming, but more so for a company that is just starting out and which may not have rigorous security measures in place. How do we battle these frauds? Is there a way to secure every individual’s personal information so that identity theft does not happen, and even if it does, that organizations are not affected by it? Short answer: Yes. Through OCR of government IDs and face recognition, such frauds can be done away with.

OCR Engine A may not be as good as B

But just about any OCR engine will not work. You need a highly accurate OCR engine. This will ensure smooth customer onboarding on your app, reduced turnaround times and improved customer retention apart from fraud detection. The accuracy of an OCR engine is affected by several factors such as quality of paper and ink used, smudges, artifacts present and so on. When you opt for an OCR engine backed by AI/ML, its accuracy increases substantially, especially when the model is well-trained.

Not just any face recognition system will suffice

The same goes for a face recognition system as well. There are several generic solutions out there,many of them available online and free to use. But their accuracy levels are very low. So while they may help for smaller groups of people or for social experiments, for the purpose of business, a more accurate AI backed solution is required. Otherwise there is risk of racial bias. Let us consider the case of Microsoft’s face recognition software Face API. Labor Unions in the UK were of the opinion that the face recognition system on the app does not identify black drivers. Due to misidentification, several black drivers received notices from Uber and had their accounts deactivated.

Build vs. Buy: Pick the latter, here’s why!

So now that you know as a business to onboard customers reliably, you need face recognition and OCR working in tandem. Do you build the necessary technologies in-house or do you opt for the expertise of a third party. Even if you are able to understand your requirements, find good AI engineers and set timelines, developing AI models in-house is a tough task. You also need to find sample data and keep updating the code against newer benchmarks, to combat evolving frauds and to support different types of documents. Can you imagine an entire product team for just building, designing and maintaining just that? If building computer vision and capable image processing serves as a strategic differentiator to your core business as well, then it might make sense. Else it really does not.

When companies opt for a third party identity verification solutions provider, companies can focus on their core business, and let an expert take care of the AI models and face recognition. Having an organization with the right expertise partnering will help drive more ROI as you scale.

Because all are not built the same way!

Now that you have decided to buy, how do you make sure that you are going in for the right service provider for your OCR and your face recognition feature? These are some of the things you can do:

For OCR:

- Go in for an on-demand OCR engine which will allow direct API requests and faster processing, much like HyperVerge’s Hyper Turing engine.

- Opt for an OCR service provider, continuously benchmarking against industry standards and making the latest version available to you.

For Face recognition:

- Opt for an AI-based identification services provider top ranked in NIST, like HyperVerge.

- Look for additional features like passive liveness detection that helps fight static and dynamic attacks.

- Look for 1:n face dedupe detection.

For both:

- Compare performance with slightly skewed, blurry, or dark images.

- Check if integration with other third party systems you use is possible, how easy it is, and if any kind of coding is required. HyperVerge has a co-code solution!

- Compare solutions from several service providers, or just opt for HyperVerge!

Closing words

The good news is that constant vigilance doesn’t have to come at a hefty price or be needlessly complex. While you can opt for a low-cost solution or build one in-house, by now you may be convinced not to take that route. When you are opting for a third party solution provider whom you can trust, be sure to check everything we have just mentioned in this article to ensure you are getting a good deal. And if you do have the time, talk to us.

FAQs

What is digital fraud?

Digital fraud is when cybercriminals use email scams, phishing websites, harmful software, and other digital means to steal your personal information or con you out of money.

How to combat digital fraud?

1. Never share your personal information 2. Always use secure websites 3. Keep your passwords secure 4. Keep close watch of your bank statement when purchasing anything online 5. Use credit cards in place of debit cards